Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments 2×2 Galvanized Tubing

Click Here for 150+ Global Oil Prices

Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

Click Here for 150+ Global Oil Prices

Start Trading CFDs Over 2,200 Different Instruments

Click Here for 150+ Global Oil Prices

U.S. Natural Gas Prices Tumble 10% on Mild Weather

Russia and Saudi Arabia are…

Putin's quick trip to the…

Oil prices hit June-2023 lows…

MetalMiner is the largest metals-related media site in the US according to third party ranking sites. With a preemptive global perspective on the issues, trends,…

The Construction MMI (Monthly Metal Index) rose for the first time in five months, welcoming a 3.97% increase. However, this rise could prove deceiving as the index still faces numerous bearish sentiments. Bar fuel surcharges rising helped the index rise month-over-month, along with did aluminum bar prices. Steel rebar and h-beam steel prices, on the other hand, moved sideways. Indeed, China is their primary source, and the weakening of Chinese imports caused both to suffer. In total, Chinese imports into the U.S. fell 7.9% compared to August 2022. Buyers who purchase these particular forms of steel are encouraged to place other sources outside of China on the back burner in case sourcing from China becomes infeasible. To get a scope of metal market price forecasts and the best sourcing tactics for 2024, subscribe to the Annual Metals Outlook.

China’s economic downturn and the ongoing trade dispute with the U.S. continue to cause drops in steel demand. According to Reuters , any indications of true contraction in China, which continues to be the main driver of demand growth worldwide, are particularly bad news for the metals industry. China’s first-quarter trade numbers reflect the rising supply pressures, with imports of ores and concentrates declining in volume and flow.

The delayed rebound in China’s economy weighed on demand, resulting in gloomy sentiment in industrial metals markets. Consensus price projections barely moved in May 2023 . This was most likely because the continuous volatility and unpredictability of the macroeconomic environment directly impacts the cost of commodities, steel, and other metals sourced from China.

Some experts project that China’s pent-up demand for steel will continue in the second half of 2023 . In March’s policy meetings, there was a call to slow down China’s conservative economic policy program for 2023. However, concerns over demand from a pivotal buyer persist, even though Bloomberg reports that China’s industrial downturn slowed slightly . Despite this, China’s economy continues to create an overall slump in global base metals.

The downturn in Chinese manufacturing also affects U.S. builders, with the decline in Chinese imports into the U.S. being one of the primary results . Indeed, government officials continue to prepare for economic damage as China’s imports of everything from electronics to building materials decline.

Since China is a significant steel exporter, the decline in Chinese imports has resulted in lower steel prices in the U.S . As demand growth slows and the surplus supply burdens the market, analysts predict that Chinese steel prices will decline until 2024 . Given that steel goods like rebar are a significant part of the building process, this decline in steel prices directly impacts the construction industry.

However, the impact of the decline in Chinese imports goes beyond steel prices alone. For instance, the cost of building materials in the U.S. has increased by around 2% due to the trade war . The additional taxes on Chinese imports, which have raised the price of building supplies, are also to blame for this rise. The decline in Chinese imports has also caused a glut of Chinese steel throughout Asia . As a result, Indonesia, Thailand, and India continue to prepare to support their players as they fend off price declines.

More Top Reads From Oilprice.com:

Utility Negligence In Maui Fires Sparks Nationwide Infrastructure Debate

Why The Oil Outage In Iraqi Kurdistan Continues

MetalMiner is the largest metals-related media site in the US according to third party ranking sites. With a preemptive global perspective on the issues, trends,…

The World’s Second-Biggest Coal Company Is Looking to Exit the Industry

Oil Demand Will Take a Hit from Yet Another Decline in U.S. Manufacturing

China Launches World's First Fourth-Generation Nuclear Reactor

U.S. Cements Position as Energy Superpower with Soaring Oil Exports

Latest Cuts Leave OPEC with Fewer Options

The materials provided on this Web site are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Nothing contained on the Web site shall be considered a recommendation, solicitation, or offer to buy or sell a security to any person in any jurisdiction.

Trading and investing carries a high risk of losing money rapidly due to leverage. Individuals should consider whether they can afford the risks associated to trading.

74-89% of retail investor accounts lose money. Any trading and execution of orders mentioned on this website is carried out by and through OPCMarkets.

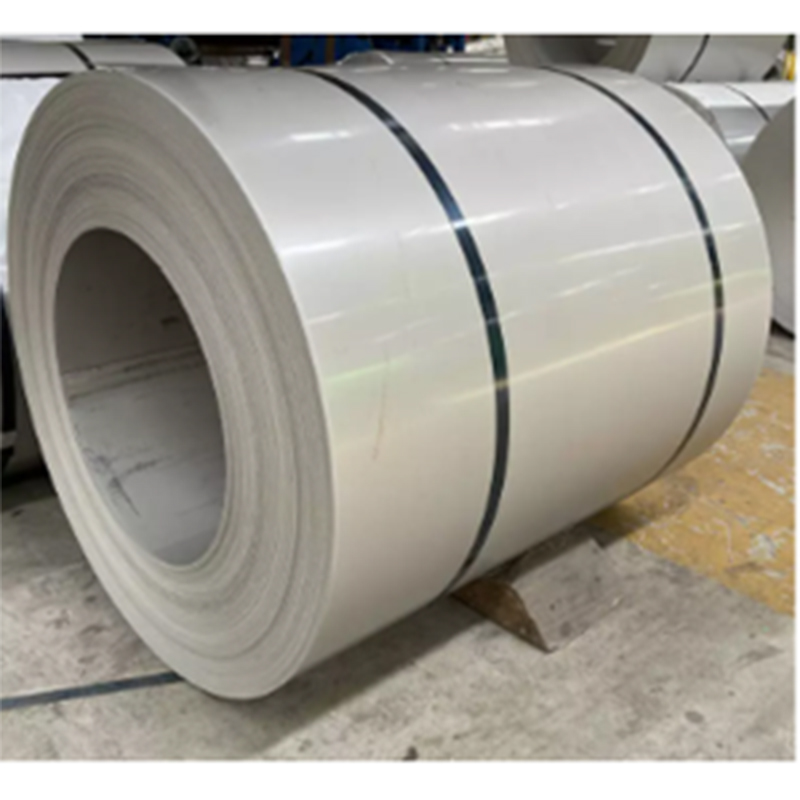

China Hot Rolled Coil and Cold Rolled Coil Merchant of Record: A Media Solutions trading as Oilprice.com